We have a good definition of risk in the major indices and the three major barometers flashing buy signals. Transports broke above the downtrend line and are holding. The theory behind transports being a market tell is that if transports are going up, it indicates goods are being shipped so there is demand for freight in the end markets.

The KBW Bank Index is similar. Technical analysis theory for a breakout above a down trend line goes something like this: when stocks go down, a resistance line is created as longs wish they had sold the day before and potential shorts have regret for not shorting. Both groups of traders would be willing to sell stock if prices get back to where they were the day before. This resistance line is valid after 3 tags. After enough selling has taken place and enough time has passed, the selling will be complete as anyone who wanted to sell, already has. The buying pressure is greater than the selling pressure and the stock may break out above the down trend line. This is our signal that the selling is complete. Now the reverse psychology takes hold: traders that sold wish they hadn’t, and potential buyers wish they had bought. Both groups would be willing to buy if the stock returns to the levels it was the day before. This creates a support line. When resistance is broken, by definition, and by demonstration of the psychology of traders, that line becomes support. We can see this graphically in the KRE:

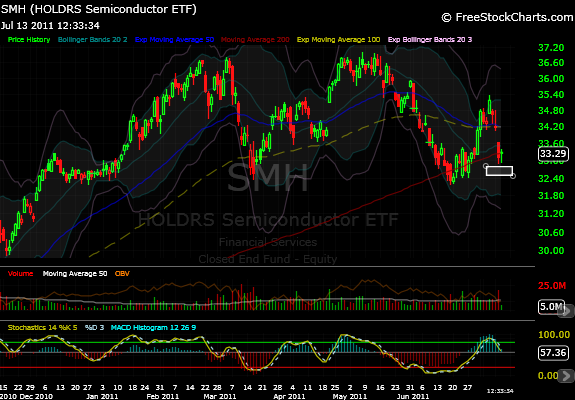

The theory behind banks and semiconductors being barometers is that a growing economy needs banks lending and semis, the commodity of technology, to be selling. The SMH represents a basket of semiconductor stocks. We can see it is holding the previous intraday low, which is also a higher low from June. We can infer from this that sellers have exerted their maximum selling pressure yesterday, and this was less than the maximum selling pressure from the previous low in the middle of June. We have a good indication that the selling pressure has subsided and any good catalyst will create buyers. The white box shows the higher low.

With the Transports, the Banks, and the Semiconductors all showing signs of going higher, we can be a bit more bullish and take on some risk if our risk profile allows for additional risk. If any of these fail to hold, or the major indices start to break down, our thesis is in jeopardy and we should change course.