“A Child having taken notice of nothing in the metal he hears called gold, but the bright shining yellow colour, he applies the word gold only to his own idea of that colour, and nothing else; and therefore calls the same colour in a peacock’s tail, gold. Another that hath better observed, adds to shining yellow, great weight; and then the found gold, when he uses it, stands for a complex idea of a shining yellow and very weighty substance. Another adds to those qualities fusibility; and then the word gold to him signifies a body, bright yellow, fusible, and very heavy. Another adds malleability. Each of these uses equally the word gold, when they have occasion to express the idea which they have applied it to; but it is evident, that each can apply it only to his own idea, nor can he make it stand as a sign of such a complex idea as he has not.”

-John Locke, An Essay Concerning Human Understanding

In 1998, ANOTHER expressed his idea about how to value gold and how to think the prices of things we use like oil. Specifically, in a post from Jan 1998, entitled: The final outcome of “Too Much Oil”, “Too little Gold” and “Worldwide Digital Currencies” he laid out how the price of gold vs. the price of oil has little relation to the value of gold vs. the value of oil.

A key takeaway was that the price of oil could be made extraordinarily cheap, if the price of gold were to made extraordinarily high. Ever since May 2020, when WTI crude cleared at negative prices, the idea of what gold bidding for oil means became clear.

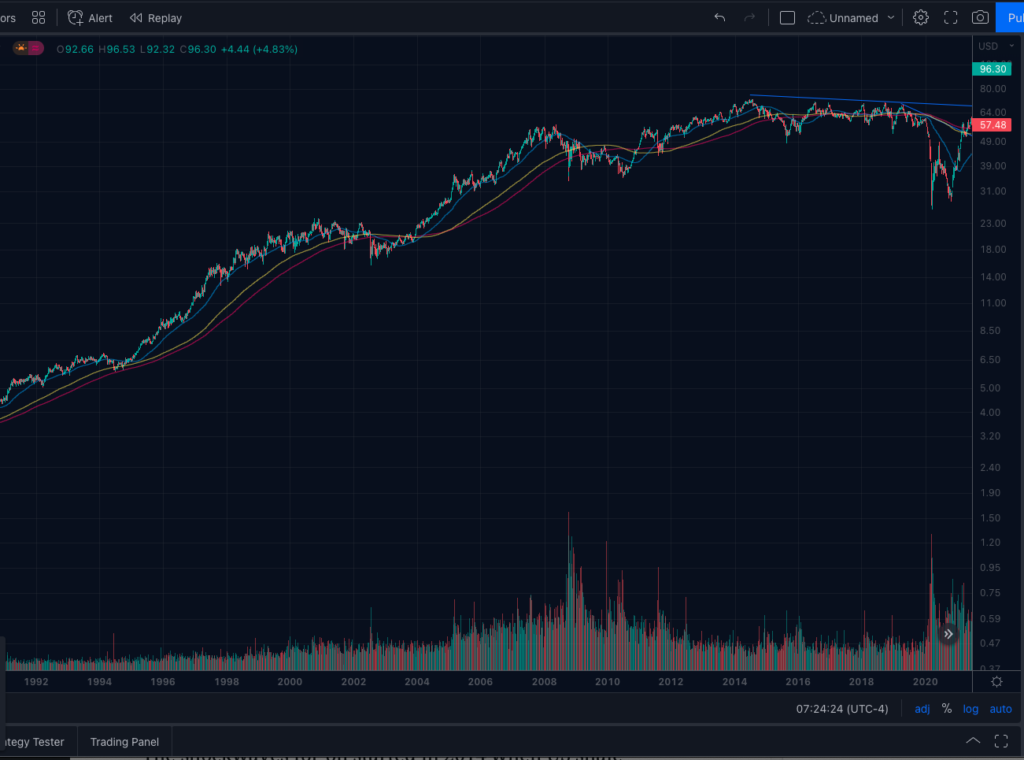

Consider this chart of $XOM:

We can see the possibility of a long term top in the oil company.

Usually such a drastic movement in a major stock should be dismissed. However, when ANOTHER’s idea is taken in conjunction with the price chart and the negative clearing price of oil in 2020, the possibility of a repricing of oil becomes apparent.

The shockwaves for oil started in 2014 when US shale oversupplied the market. All oil companies, even XOM, have had to take down their book value based on a lower price for reserves since that time.

As ANOTHER writes:

“Now we approach the final act.

There is one oil state that no one will play for a fool. The CBs will sell all of their gold or the nations will nationalize all mines and operate them at a loss. One way or another, most of the paper gold market will be honored. Why? Because oil will bid for gold if they do not! We are not talking about an oil embargo or rising oil prices. Indeed, oil will become very cheap for those that can supply physical gold. This deal will not require the agreement of all oil states. Only one can start this, the others will gladly follow.

A large oil producer, with plenty of reserves and unused capacity, can say: We now value gold at $10, $20 or $30,000/oz.. That is the rate we will use to sell oil. We will go to “full” production and offer at $10.00us/bl.. Pay us in physical gold and USD ( or EUROs ) as a 50% mix to the above rate to equal $10/bl..

It would be a deal like none other! Oil, worldwide, would drop to $10.00/bl and every economy would do very well, IF they had gold. All gold would immediately be arbitraged to the above prices thereby creating a “world oil currency” large enough to handle oil. This creating of a new “specialized currency” will be the result of the first “commodity corner” that ever succeeded!”

Which oil state could do this? Perhaps the photo below holds a clue:

$10 oil and $1.25 gasoline would be a boon to every oil consuming economy on earth.

But what of the oil producers? Under a gold-for-oil pricing scheme, the oil state would have secured wealth in the form of gold that will last as long as humanity exists on earth. Accepting a lower USD price for oil at break even around $10, and a fraction of an ounce of gold for each barrel of oil sold would render the oil state more diversified. This seems to be a reasonable desire for an oil producer.

Which brings me back to the chart of $XOM. If this gold-for-oil pricing scheme is imminent, the price action and breaking of long term trends in $XOM is exactly what one would expect…