We are choosing this stock to analyze because their branding on the grocery store shelf is good enough to garner our attention as a shopper, so that is as good of a reason as any to garner our attention as an investor.

The first step is to gather the financials and notes to financials from the SEC Edgar website. We need to gather all the statements, not just the main three that are standard on financial websites. All together we get five statements. The standard three are the balance sheet, income (aka: operations) statement, and cash flow statement. Additionally, we’ll want the other SEC required statements: statement of changes in shareholder equity, and other comprehensive income. We also need the notes to financial statements which contain the supplementary data that explains all the accounts in the financial statements, the disclosures of accounting policies, and the management discussion, analysis and commentary. These are all obtained from the 10-K.

The contents page provides a link to the Selected Financial Data that we are interested in. The very first thing you should always see in the financial reports is the auditor’s opinion on the financials. This is a legal requirement. You should see something along the lines that the financial position is represented “fairly.” This is an “unqualified opinion.” You don’t want to see any “qualifications” which means the financial position would be represented fairly if some additional conditions were to be met. If some company is dumb enough to submit an audited report with a “qualified opinion” then you don’t need to waste your time analyzing it. It’s not a situation you want to get into.

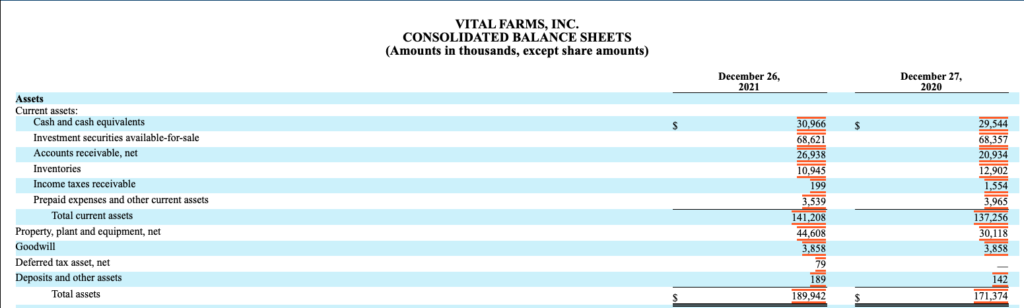

So now that we’ve gotten the broiler plate stuff out of the way, we can move on the the analysis in earnest. We notice the balance sheet accounts, first the assets:

Ideally, we would want to compile the raw data into a common size balance sheet, so let’s go ahead and do the right thing by cutting corners and eye-balling the numbers…

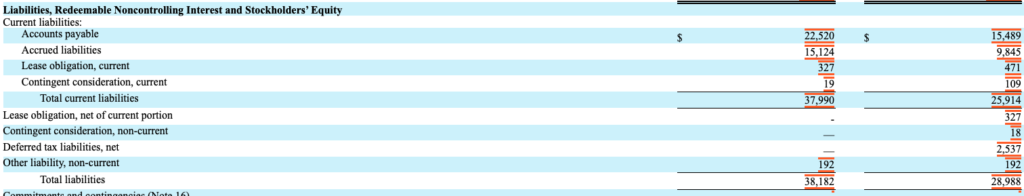

The first thing that should stand out is the investment securities account is the largest part of the total assets. It’s even larger than the property, plant, and equipment account. (Now this is surprising as their plant, (Egg Central Station) is a state of the art egg sorting and packing facility that we can learn about in the management discussion and analysis). So we should be wondering to ourselves: what stocks/ bonds are they holding as investments for sale? This designation means they are not holding them long term like Warren Buffet says he does. Vital has most of its assets as traceable securities- why? Let’s keep it in mind, and add to that list of questions anything else we have questions about to look for an answer when we get to the notes to the financials. Further examination of the balance sheet shows us the property plant and equipment is aggregated, and not broken down into leased or owned so we’ll want to know that- we can see from the liabilities that the current lease obligation completes the total long term leases so we can conclude they own the property that their Egg Central Station plant is situated on. It’s a matter of opinion if leasing or owning is better, and we can conclude that owning this plant puts Vital in a better situation than leasing. They have flexibility to expand and we know that no cash will be spent on rent in the future. The main thing we notice- no debt account, because they carry no debt on the books. This is what we like to see. Again, this is a matter of opinion, but we, as equity investors, see debt as a burden and a competition for resources for us, the potential owners of equity.

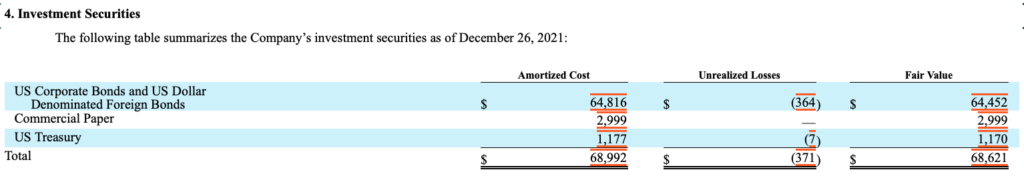

Now, let’s see if we can find out anything about those trading investments they hold. So we just scroll down to the notes way to fast to make sure we didn’t miss anything until we see something that stands out as investments in stocks or bonds, and this pop’s out:

So there we have it, their investments, the largest portion of their asset base, is held mostly in US corporate bonds, and a little bit of short term paper and US Treasuries. OK so that alleviates our concern about the investments. They just had lots of cash, and rather than let it sit around idle, the CFO invested in bonds. We would like to know the quality of the corporate bonds, but we are just not given this level of detail, and they are not required to give it. We could call or email the investor relations to ask if we really wanted to know, but we don’t for now so we’ll just assume its a mix of quality ranging from investment grade to junk, probably tilted towards junk.

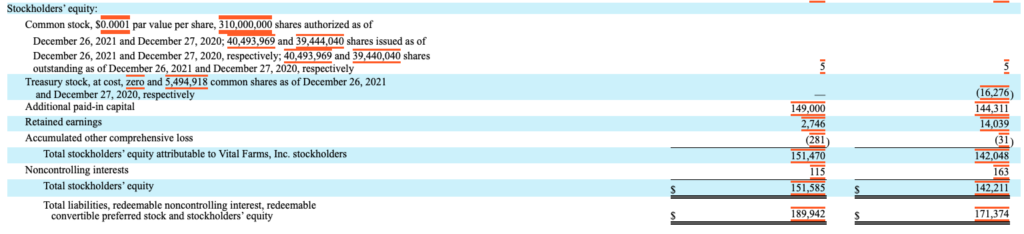

Lastly, to conclude our balance sheet analysis, we take a look at shareholder equity:

This is the residual claim on the companies resources. The equity is $151M of the total assets of almost $190M, so we as equity owners would have claim to tons of the companies resources. This is what we want to see.

With a market cap currently at $420M, we have claim to $150M of decent assets so that seems like not an unreasonable price to pay for the shares just on an analysis of the asset base.

So next time we will look into the rest of the financial statements to see what we can find.