*Link to WSJ article referenced

Investing is getting harder- because we are all slowly understanding that the game is not what we were taught it was. (If it’s not clear to you now that we are not operating under the rules of capitalism, then there is no use in convincing you- you are a lost cause and likely a mindless consumer who allows the TV to “inform” you about reality).

The reason investing is getting harder is because risks are compounding and immeasurable. It is becoming more apparent our leadership is completely inept, and we are being mislead about virtually everything: White House press briefings are 100% narrative creation and spin, and journalism is an echo chamber. The press has no power to seek truth or inform the public. So we the public have no ability to make informed decisions about how to act. A case in point: we are in a new cold war and are going through the equivalent of nuclear attack drills and crouching under desks. Ever wonder what it was like to have been a rational, thinking person and seeking your kids be told to hide under their desk during a nuclear attack drill? Wonder no more; vaccine mandates are exactly the same thing- not similar- exactly the same.

But, people are scared and misinformed so we travel further and further down an unknown road in the dark because we are following a map created by a blind cartographer. Similarly, the problem we face in investing is no different- we are making irrational decisions about how to take on risk because are misinformed about what risks actually are.

The WSJ article above is actually some valuable journalism in a mainstream publication, which is rare. Through the article, Jason Zweig gets the reader to focus on taking risks vs. seeking risks.

Modern portfolio theory is the exact same as a White House press briefing- not similar, but exactly the same. We all gather in a room and Wall Street tells us professional investors how to think about investing. There are credentials (CFA designation) that anyone in the “press room” must have that weed out any “wrong thinking” just like any one with a press pass has been filtered through a journalism school and received a press pass.

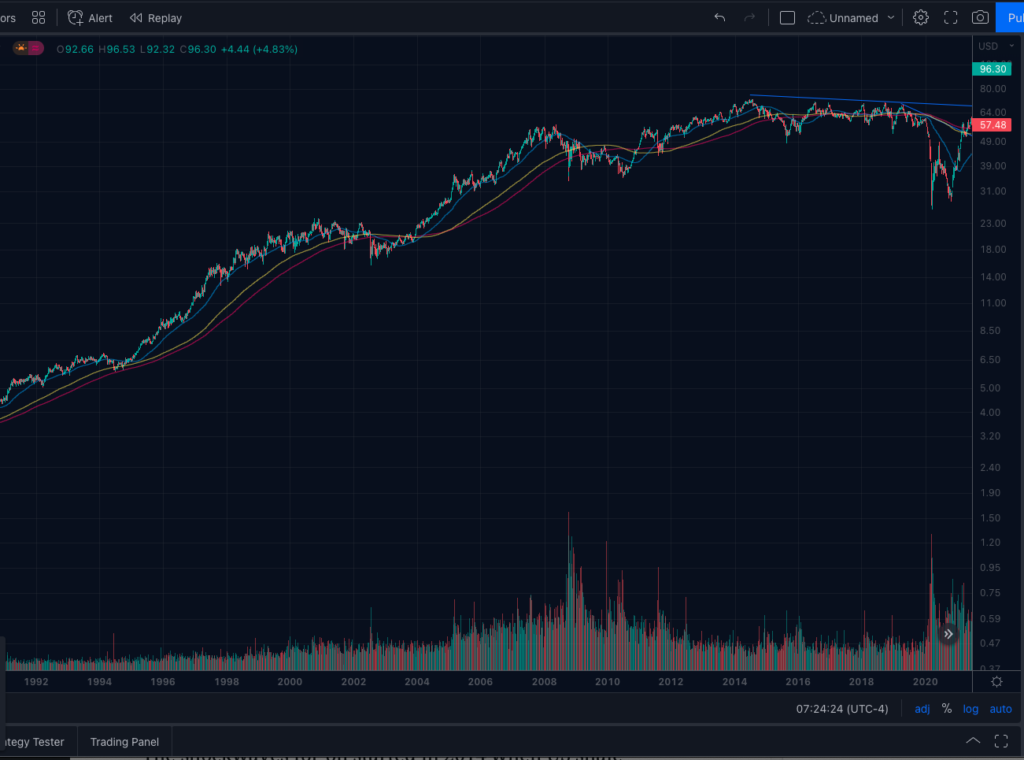

We are mislead to think that risk is volatility, and volatility is a standard deviation of returns around a mean return. But, anyone living in reality must know by now that this is nonsense. And yet, all savings across the developed world are invested as though this concept is a reality. It worked in the USA up until the dot com crash. Then the Fed embarked on a mission to uphold asset prices. The Fed wasn’t the first and the dot com bust wasn’t the first evidence that portfolio theory is a crackpot theory- Japan and their boom and bust in the 80’s and the Bank of Japan’s QE was the first event that proved modern portfolio theory was indeed a crack pot theory. But men in charge of society followed irrational policies anyway- same mentality that brought civilization into WW1; they all knew going to war was insane, but no one seemed able to stop anyone else from traveling down the road to war- following a map made by a blind cartographer.

So how, as investors, traders, speculators, and any guy who’s come to the realization that the economic system is mostly rigged and real wealth is not going to be attainable by honest means take on risk when our risks are immeasurable?

The answer lies in balancing our decision making between two engines: our intellect and our imagination. Under the classic rules of capitalism, we would want to bias our decision making heavily towards intellect and mostly ignore our imagination. Now that it’s apparent the USA no longer operates under a capitalist system, we’ve got to incorporate our imagination more. But letting imagination take over our decision making can lead to errors the same as trying to use intellect to make decisions (alt-coin cyrptos and NFTs appear to be letting imagination run too wild, while Bitcoin and maybe Ethereum appear to be using just enough imagination).

So use your intellect to analyze industries of interest, read 10-k reports, and assess the general conditions. Use your imagination to understand to determine what is reality.